Oligopoly is a common market form. As a quantitative description of oligopoly, the four-firm concentration ratio is often utilized. This measure expresses the market share of the four largest firms in an industry as a percentage. For example, as of fourth quarter 2008, Verizon, AT&T, Sprint Nextel, and T-Mobile together control 89% of the US cellular phone market.

Oligopolistic competition can give rise to a wide range of different outcomes. In some situations, the firms may employ restrictive trade practices (collusion, market sharing etc.) to raise prices and restrict production in much the same way as a monopoly. Where there is a formal agreement for such collusion, this is known as a cartel. A primary example of such a cartel is OPEC which has a profound influence on the international price of oil.

Firms often collude in an attempt to stabilize unstable markets, so as to reduce the risks inherent in these markets for investment and product development. There are legal restrictions on such collusion in most countries. There does not have to be a formal agreement for collusion to take place (although for the act to be illegal there must be actual communication between companies)–for example, in some industries there may be an acknowledged market leader which informally sets prices to which other producers respond, known as price leadership .

In other situations, competition between sellers in an oligopoly can be fierce, with relatively low prices and high production. This could lead to an efficient outcome approaching perfect competition. The competition in an oligopoly can be greater than when there are more firms in an industry if, for example, the firms were only regionally based and did not compete directly with each other.

Thus the welfare analysis of oligopolies is sensitive to the parameter values used to define the market's structure. In particular, the level of dead weight loss is hard to measure. The study of product differentiation indicates that oligopolies might also create excessive levels of differentiation in order to stifle competition.

Profits maximization conditions : An oligopoly maximizes profits by producing where marginal revenue equals marginal costs.

Ability to set price : Oligopolies are price setters rather than price takers.

Entry and exit : Barriers to entry are high. The most important barriers are economies of scale, patents, access to expensive and complex technology, and strategic actions by incumbent firms designed to discourage or destroy nascent firms.

Number of firms : "Few" – a "handful" of sellers. There are so few firms that the actions of one firm can influence the actions of the other firms.

Long run profits : Oligopolies can retain long run abnormal profits. High barriers of entry prevent sideline firms from entering market to capture excess profits.

Product differentiation : Product may be standardized (steel) or differentiated (automobiles).

Perfect knowledge : Assumptions about perfect knowledge vary but the knowledge of various economic actors can be generally described as selective. Oligopolies have perfect knowledge of their own cost and demand functions but their inter-firm information may be incomplete. Buyers have only imperfect knowledge as to price, cost and product quality.

In an oligopoly, firms operate under imperfect competition. With the fierce price competitiveness created by this sticky-upward demand curve, firms use non-price competition in order to accrue greater revenue and market share.

In an oligopoly, firms operate under imperfect competition. With the fierce price competitiveness created by this sticky-upward demand curve, firms use non-price competition in order to accrue greater revenue and market share.

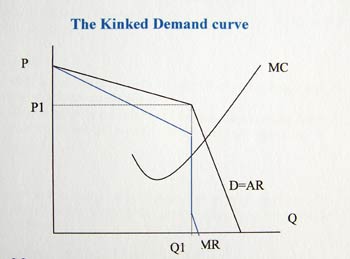

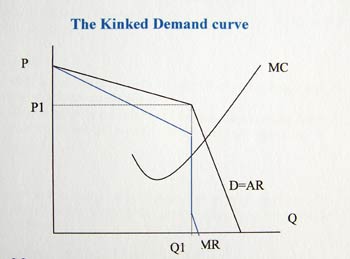

"Kinked" demand curves are similar to traditional demand curves, as they are downward-sloping. They are distinguished by a hypothesized convex bend with a discontinuity at the bend–"kink". Thus the first derivative at that point is undefined and leads to a jump discontinuity in the marginal revenue curve.

Classical economic theory assumes that a profit-maximizing producer with some market power (either due to oligopoly or monopolistic competition) will set marginal costs equal to marginal revenue. This idea can be envisioned graphically by the intersection of an upward-sloping marginal cost curve and a downward-sloping marginal revenue curve (because the more one sells, the lower the price must be, so the less a producer earns per unit). In classical theory, any change in the marginal cost structure (how much it costs to make each additional unit) or the marginal revenue structure (how much people will pay for each additional unit) will be immediately reflected in a new price and/or quantity sold of the item. This result does not occur if a "kink" exists. Because of this jump discontinuity in the marginal revenue curve, marginal costs could change without necessarily changing the price or quantity.

The motivation behind this kink is the idea that in an oligopolistic or monopolistically competitive market, firms will not raise their prices because even a small price increase will lose many customers. This is because competitors will generally ignore price increases, with the hope of gaining a larger market share as a result of now having comparatively lower prices. However, even a large price decrease will gain only a few customers because such an action will begin a price war with other firms. The curve is therefore more price-elastic for price increases and less so for price decreases. Firms will often enter the industry in the long run.

In an oligopoly, firms operate under imperfect competition. With the fierce price competitiveness created by this sticky-upward demand curve, firms use non-price competition in order to accrue greater revenue and market share.

In an oligopoly, firms operate under imperfect competition. With the fierce price competitiveness created by this sticky-upward demand curve, firms use non-price competition in order to accrue greater revenue and market share.